Mastery in Measured Movement Trading Strategy

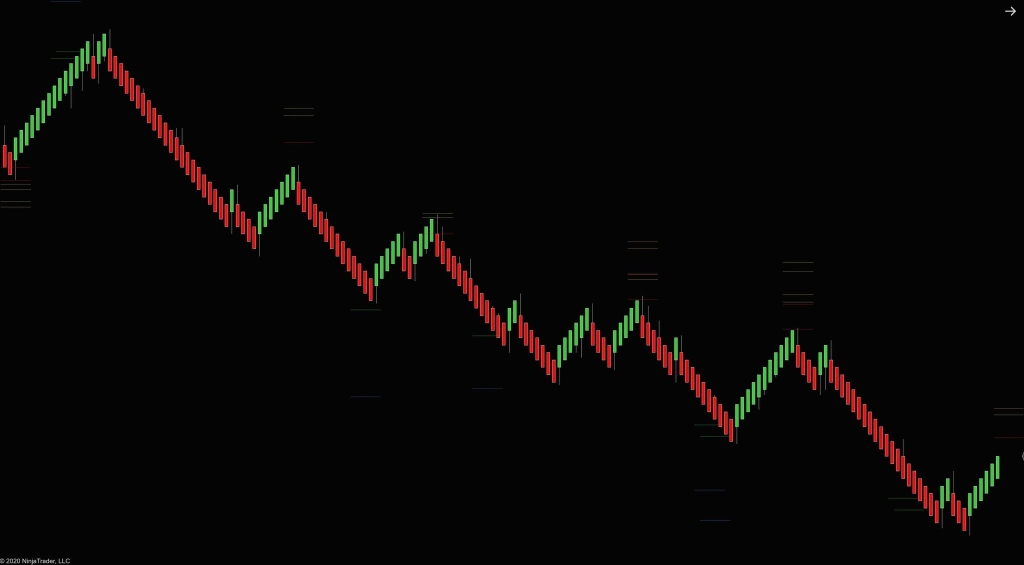

Today’s trading strategy concerns a little-known trading pattern, ALSO known as measured movement. This strategy of the measured shifted chart pattern is both a reversal and continuation strategy.

Our team of trading strategy guides is working hard to create the most comprehensive guide for various chart pattern strategies.

For more information on chart patterns, check out our ultimate guide to chart patterns.

We will delve deep into the model of measured displacement, including guidelines on how to enjoy this secret pattern. Once you understand the measured movement pattern, it will open your horizon to better understand how the price is moving.

In the future, we will discuss what constitutes a good measured movement pattern and highlight five basic trading rules to conquer the markets by trading on this awesome pattern.

Introduction: Strategy of the Measured Displacement Diagram Model

Trade-measured movement can take your trading operations to a whole new level. The surprising thing about the measured movement model is that it shows you the pace of the market. Each trading instrument has its own pace, and the strategy of the measured movement pattern can help you decipher the pace of each market.

We will also provide you with a very clear step-by-step rule set so that you can exchange the strategy of the measured motion diagram template yourself. Here is a strategy that you can read and it is called the risk-reward ratio.

What Is A Measured Movement In Trading?

The measured movement pattern is an old-fashioned chart pattern that indicates that the market tends to move in a similar price structure as recently. Not only the price distance should be the same, but also the time it takes to reproduce the same movement should be almost the same.

It is based on the idea that historical price movements often provide clues about future price movements.

If we talk about the measured movement pattern, it’s not just about the distance that the price travels, but also about how long it takes for this movement to occur. In essence, it is looking for patterns where the price structure and duration of a previous movement are very similar to those of a current movement.

For example, if the market makes a significant upward movement, for example, within two weeks, the measured movement pattern indicates that a subsequent upward movement of a similar magnitude could occur in a similar period of time. This means that not only the achieved price level would be similar, but also the speed and duration of the movement would exactly coincide.

Measured movements can be found in all markets and at intervals of all times. See below to learn more about the two types of measured displacement patterns. By identifying these trends, they aim to anticipate potential price movements and make informed trading decisions based on historical precedents.

As a disclaimer, it is important to remember that while such models can provide valuable information, they are not foolproof and should be used in conjunction with other technical analysis tools and risk management strategies.

Measured Uptrend (Bullish)

Let’s say the price action starts at the low pivot A and goes up to a high pivot called B. Then it moves from pivot B to C and gathers again to a new high pivot D.

Measured downward movement (Bearish)

Imagine a scenario where the price movement starts from a high pivot labeled a and then gathers downward to form a low pivot labeled B.

This sequence of price movements characterizes what we call a measured downward movement or bearish measured movement.

The Psychology Behind The Measured Bullish Movement.

Trading with the measured movement pattern gives us clues about the direction of the trend and also about the strength of the trend.

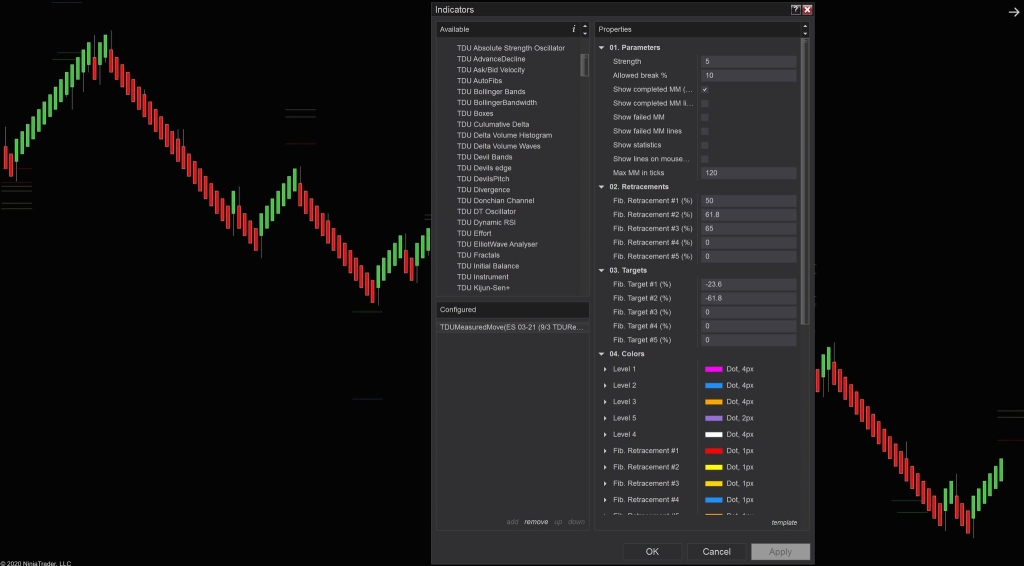

The strength of the trend lies in the BC retracement. We will use the 50% retracement of the ab price range as a guide to trade the measured movement and confirm the strength of the trend.

If point C retraces less than 50% of the range before trading above point B, we can call this uptrend very strong. However, if the retracement at C falls below 50%, we can conclude that the trend is weak.

You can call the measured movement of forex only after in the actual development of the model. But once you get the first step up, we should expect the same double on the second step, so trading with the measured movement pattern should be an easy task.

Trading Strategy for Measured Movements-purchase rules

The measured motion chart strategy is an easy way to make money by trading Forex. You just need to use this step-by-step guide on how to use the measured movement, and you will keep up with the pace of the market.

In essence, trading with the measured movement is simply an attempt to predict how far the market will continue to move after a price event.

Leave a Reply